Copyright ©2022 Jack and Gill | All rights reserved

Privacy Policy | Where did you obtain my information?

Will Life Insurance Pay Out for Cancer?

Well, it depends on what you mean by ‘for cancer’.

If you were to unfortunately die of cancer, then absolutely! Life Insurance pays out for any cause of death. So, whether you were to die of cancer, a heart attack, a shark attack, or any cause that you can think of, your life insurance policy will pay out.

When Might Life Insurance Not Pay Out?

The only reason your life insurance policy wouldn’t pay out, is if you lied or deliberately misled the insurance provider during your application. This includes withholding important medical information or even lifestyle information. By this, we mean smoking status or whether you participate in dangerous sports, for example.

Sound like a lot of pressure? We know. But don’t worry, they’re not trying to trick you. The questions are super straight forward.

To prove how easy it is, you might be surprised to find out how much most life insurance providers pay out.

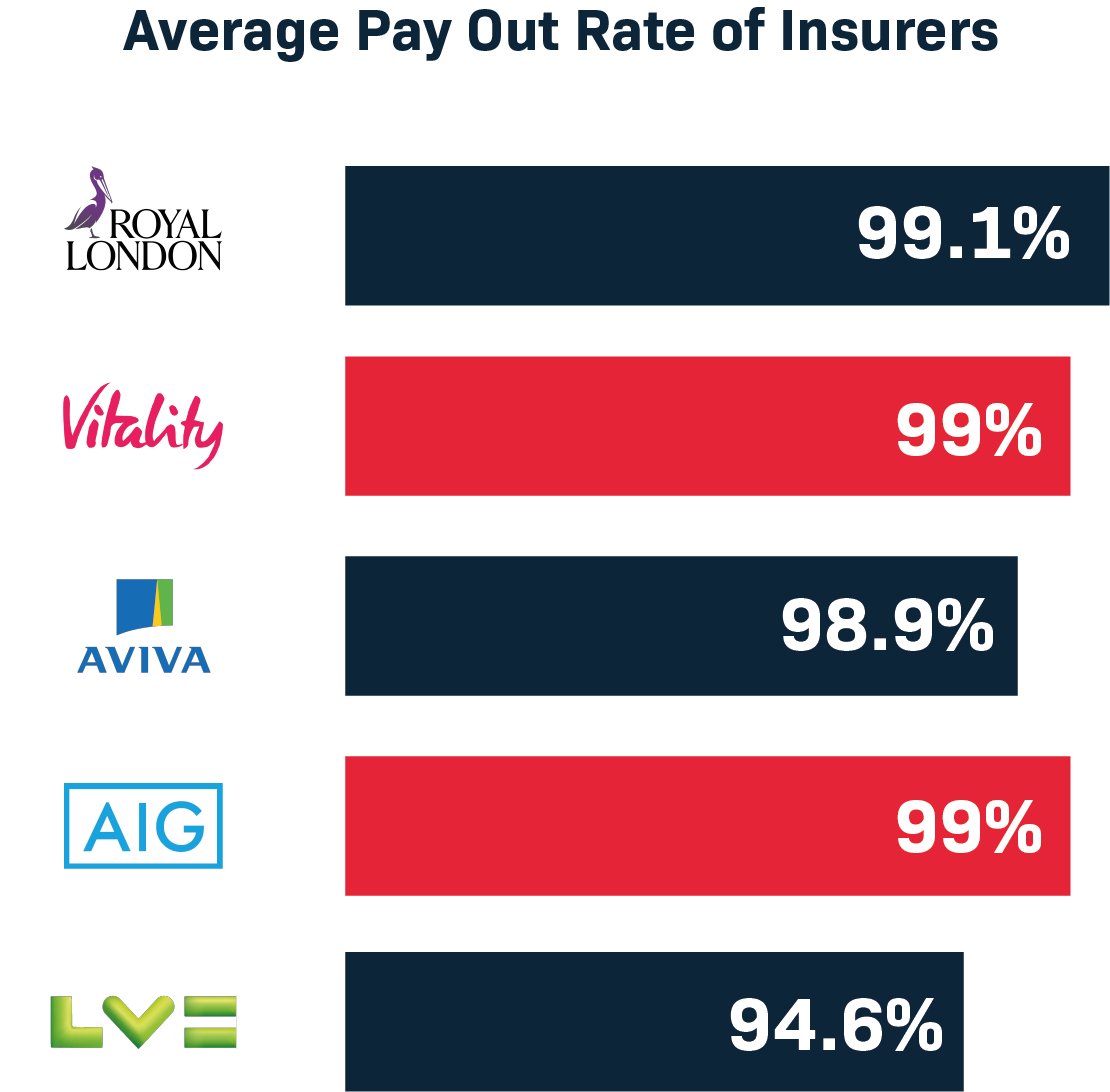

At Jack & Gill, we only partner with prestigious insurers. That way, we ensure that the average pay-out rate on our policies is never lower than 94%. That means that if 100 claims were made, at least 94 were paid-out in full.

Check out the chart below to see how providers fare against each other.

So Yes, Life Insurance Pays Out for Cancer?

So, now you’re thinking it sounds like a resounding ‘YES’ to this question. Well, there are two interpretations to this question to consider.

What if you were diagnosed with cancer but haven’t died?

If you have an ordinary life insurance policy that pays out upon the policyholder’s death, then no. In this scenario a life insurance policy would not pay-out for cancer. That’s because life insurance protects your family in the tragic event of the policyholder’s death. Here, in this scenario, whilst tragic, the policyholder has not passed away.

If you would like to receive a pay-out if you were to be diagnosed with cancer and not after your death, then you would need a Critical Illness Policy.

In addition to this, it’s essential to check what your insurer covers. That’s because some insurance providers protect against more critical illnesses than others. So, if you’re taking out critical illness cover, make certain that you discuss the advantage and disadvantages of each insurer with your advisor.